5 Steps to Craft a Balance Sheet in Excel

Financial management and analysis is an essential part of running a business, and one of the key financial statements that provide an overview of a company’s financial health at any point in time is the Balance Sheet. Crafting a balance sheet in Excel can be straightforward if you follow some well-defined steps. Here’s how you can create your own financial statement quickly and efficiently, using Excel's powerful features.

Step 1: Understanding the Components

A balance sheet has three main sections:

- Assets: Everything the company owns that has value.

- Liabilities: What the company owes to others.

- Equity: The owner’s share in the company or retained earnings.

To ensure you get your balance sheet right, understanding these categories is key because the total of Assets must always equal the sum of Liabilities and Equity.

Step 2: Setting Up Your Excel Sheet

Let's set up your Excel sheet:

- Open a new workbook in Excel.

- Label column A with headers:

- Account

- Assets

- Liabilities

- Equity

- Merge and center the titles "Assets", "Liabilities", and "Equity" over the appropriate number of columns.

Here's what your setup should look like:

| Assets | Liabilities | Equity | |||

|---|---|---|---|---|---|

| Current | Non-Current | Current | Long-Term | ||

📝 Note: This setup will help you organize the data better by distinguishing between current and non-current assets and liabilities.

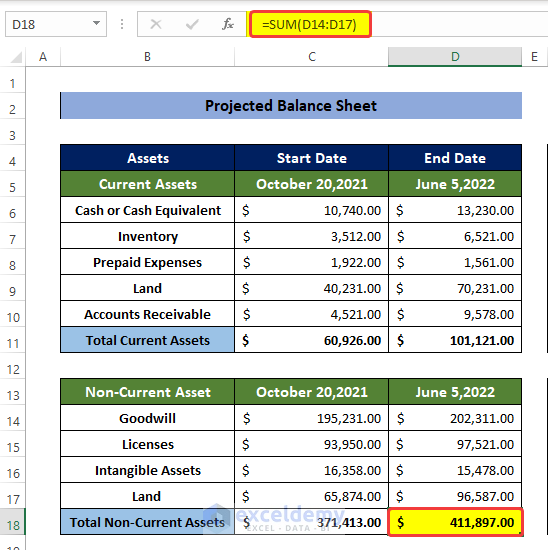

Step 3: Entering the Data

Now, you'll need to enter all your financial data:

- Under "Assets":

- Current Assets: Cash, Accounts Receivable, Inventory, etc.

- Non-Current Assets: Property, Equipment, Intangibles, etc.

- Under "Liabilities":

- Current Liabilities: Accounts Payable, Short-term Debt, etc.

- Long-Term Liabilities: Long-term Debt, Bonds Payable, etc.

- Under "Equity":

- Owner’s Equity or Stockholder's Equity

Remember to format the cells for numbers to reflect financial data correctly:

- Select the cells where you'll enter the data.

- Go to "Home" > "Number" > Choose "Accounting" or "Currency".

- Adjust decimals if necessary.

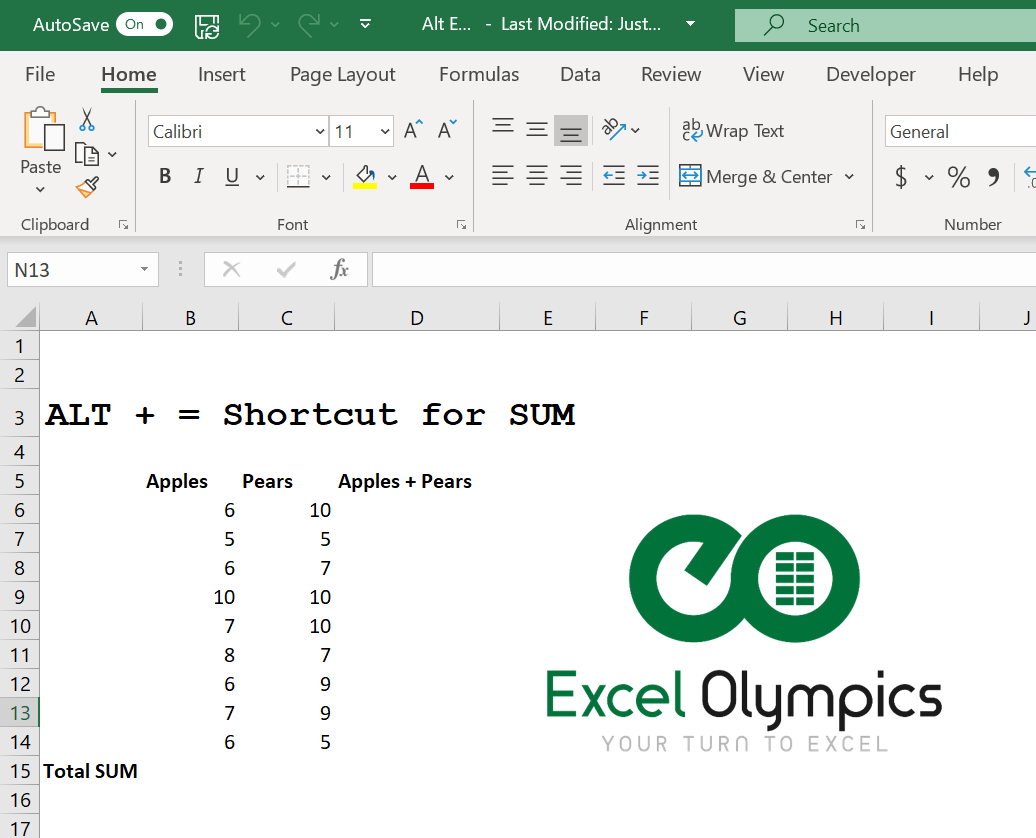

Step 4: Formulas for Summing up

Use Excel formulas to sum up each category:

- At the bottom of each column, insert a formula to sum up the respective amounts. For example:

- In the "Current Assets" total cell, use "=SUM(B3:B10)" assuming you have entries from rows 3 to 10.

- Similarly for "Non-Current Assets", "Current Liabilities", etc.

- At the very bottom, create a formula to check if Assets = Liabilities + Equity:

- In the cell under Equity, type the formula:

"=B11 + C11 + D11 + E11" - This should match the sum of all assets.

Step 5: Formatting and Finalizing

Make your balance sheet visually appealing and easy to read:

- Use bold text for headers.

- Apply borders for a clear definition between sections.

- Format numbers with negative numbers in red or parenthesis.

- Ensure all numbers align to the right or currency formatting is applied.

- Check for any errors in calculations.

Your balance sheet should now look professional and provide a clear snapshot of your company's financial position.

Creating a balance sheet in Excel might seem daunting at first, but with these steps, you can effectively organize and present financial data. The key to mastering this task is understanding the categories of assets, liabilities, and equity, organizing your data meticulously, and ensuring the numbers balance out as they should. Not only does it provide a clear picture of where your business stands financially, but it also aids in making informed business decisions and attracting potential investors or lenders.

Why is it important to separate current and non-current assets?

+Separating current and non-current assets helps in understanding the company’s liquidity and long-term investment strategy. Current assets are those that can be converted into cash within one year or one operating cycle, which aids in assessing short-term financial health and operational efficiency.

Can a balance sheet be used for personal finances?

+Yes, individuals can create a balance sheet to assess their net worth, which includes assets like cash, investments, property, and liabilities like loans or credit card debts. It’s a useful tool for financial planning and tracking progress over time.

What should I do if the total assets do not equal the sum of liabilities and equity?

+If your balance sheet doesn’t balance, check your entries for errors or omissions. Common mistakes include incorrect formulas, double-counting or missing entries, or misclassifying items. Ensure all numbers are correct and aligned properly.

How often should a balance sheet be updated?

+A balance sheet should ideally be updated at least quarterly, though for internal analysis, some companies might prefer to update monthly or even weekly, depending on the volatility of their financial situation.

Related Terms:

- How to make balance sheet

- Balance Sheet pdf

- Balance sheet statement

- Balance sheet tutorial

- Balance sheet dashboard Excel

- How to calculate balance sheet