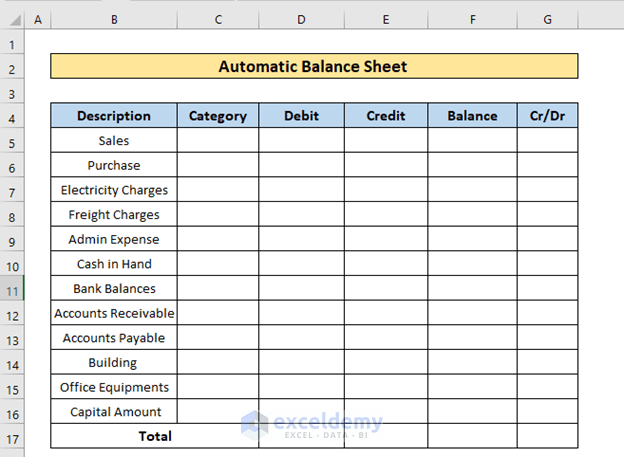

Easily Create a Balance Sheet in Excel: Step-by-Step Guide

The balance sheet is a critical financial statement that provides a snapshot of your company's financial health at a given point in time. Excel is an excellent tool for creating this report due to its powerful calculation capabilities and user-friendly interface. Here's a detailed guide on how to easily craft a balance sheet in Excel:

Setting Up Your Excel Worksheet

The first step in creating a balance sheet in Excel is to set up your worksheet. Here’s how to do it:

- Open a New Excel Workbook: Start with a blank spreadsheet.

- Create Columns:

- A: Line Items

- B: Asset Values

- C: Liability and Equity Values

- Format Headers: Use the

Boldfunction to highlight the headers as “Assets”, “Liabilities & Equity”, and leave the third column blank for now. Adjust font size, color, and apply cell borders if you want a more professional look.

Inputting Data

Once your spreadsheet is set up, it’s time to enter your financial data:

- Assets: List current and non-current assets such as cash, accounts receivable, inventory, and property.

- Liabilities: Include current liabilities like accounts payable, loans, and taxes payable. Also list long-term liabilities like mortgages and bonds payable.

- Equity: Record shareholder’s equity, retained earnings, and capital stock.

Here’s a sample table to illustrate:

| Line Item | Assets | Liabilities & Equity |

|---|---|---|

| Cash | 1,500</td> <td></td> </tr> <tr> <td>Accounts Receivable</td> <td>3,000 | |

| Inventory | 5,000</td> <td></td> </tr> <tr> <td>Accounts Payable</td> <td></td> <td>2,000 | |

| Equity | $7,500 |

💡 Note: Ensure that the values you enter reflect the financial position at the end of the period you are reporting on.

Calculating Total Values

To get your total assets, liabilities, and equity, you need to:

- Sum up the values in column B for total assets using the

=SUM()formula. - Similarly, sum up column C for total liabilities and equity.

- Verify that total assets equal the sum of liabilities and equity to ensure your balance sheet balances.

Formatting for Readability

Enhance the visual appeal of your balance sheet:

- Cell Borders: Apply borders to separate each section clearly.

- Background Color: Use subtle background colors to distinguish headers from data.

- Alignment: Right-align numbers for consistency.

- Number Formatting: Set all financial figures to currency format.

🔍 Note: Use different fonts for headers to make them stand out from the regular text.

Final Check

Before finalizing your balance sheet:

- Double-check all the entered data for accuracy.

- Ensure that the sum of liabilities and equity matches the total assets.

- Review formatting for consistency and readability.

To create a balance sheet in Excel is a straightforward process that not only helps you understand your company's financial status but also serves as an excellent way to present financial information to stakeholders. By following this guide, you can ensure your balance sheet is accurate, visually appealing, and professionally presented. Excel's functionality allows for easy updates and analysis, making it an indispensable tool for financial reporting.

How often should a balance sheet be updated?

+A balance sheet should ideally be updated at the end of each fiscal period, typically quarterly or annually, depending on the size and needs of the business.

Can I automate parts of my balance sheet in Excel?

+Yes, you can use formulas and linked cells to automate calculations and updates, reducing manual errors and time spent on data entry.

What’s the difference between assets, liabilities, and equity?

+Assets are what your company owns, liabilities are what your company owes, and equity represents the owners’ stake in the company after subtracting liabilities from assets.

Related Terms:

- worth formula balance sheet excel

- balance sheet check formula excel

- balance sheet practice worksheet excel