How To Calculate Indirect Cost Rate Percentage Excel Formula

Introduction to Indirect Costs

Indirect costs are expenses that are not directly tied to a specific project or product but are essential for the overall operation of a business. These costs include overhead like rent, utilities, administrative salaries, and office supplies, among others. Calculating the Indirect Cost Rate is crucial for budgeting, pricing products or services, grant applications, and overall financial management.

Why Calculate Indirect Cost Rate?

Understanding and applying an indirect cost rate allows organizations to:

- Allocate Costs Effectively: Determine how much of the indirect costs each project, department, or product should bear.

- Improve Pricing: Set more accurate prices for products or services that reflect the true cost of production.

- Comply with Funding Requirements: Many grants and funding sources require an indirect cost rate to be applied to calculate the total cost of a project.

- Enhance Cost Control: By tracking indirect costs, companies can find areas for cost reduction or efficiency improvements.

Understanding Indirect Cost Rate Formula

The indirect cost rate is generally calculated using the following formula:

\[ \text{Indirect Cost Rate} (\%) = \left( \frac{\text{Total Indirect Costs}}{\text{Total Direct Costs}} \right) \times 100 \]Components of the Formula:

- Total Indirect Costs: Sum of all costs that are not directly attributable to the production or delivery of goods/services.

- Total Direct Costs: Costs that can be directly linked to the production or delivery, like raw materials, labor directly involved in production, etc.

Steps to Calculate Indirect Cost Rate in Excel

1. Prepare Your Data

Before you start, ensure you have:

- A comprehensive list of direct costs by category or project.

- A list of all indirect costs.

2. Set Up Your Excel Sheet

Create a new Excel workbook with the following columns:

- Column A: Category/Item

- Column B: Direct Costs

- Column C: Indirect Costs

3. Enter the Costs

Input your direct and indirect costs under their respective columns. Here is how you might organize it:

| Category/Item | Direct Costs | Indirect Costs |

|---|---|---|

| Project A - Raw Materials | $5,000 | $0 |

| Project A - Labor | $3,000 | $0 |

| Office Rent | $0 | $2,000 |

| Utilities | $0 | $500 |

| Admin Salaries | $0 | $3,000 |

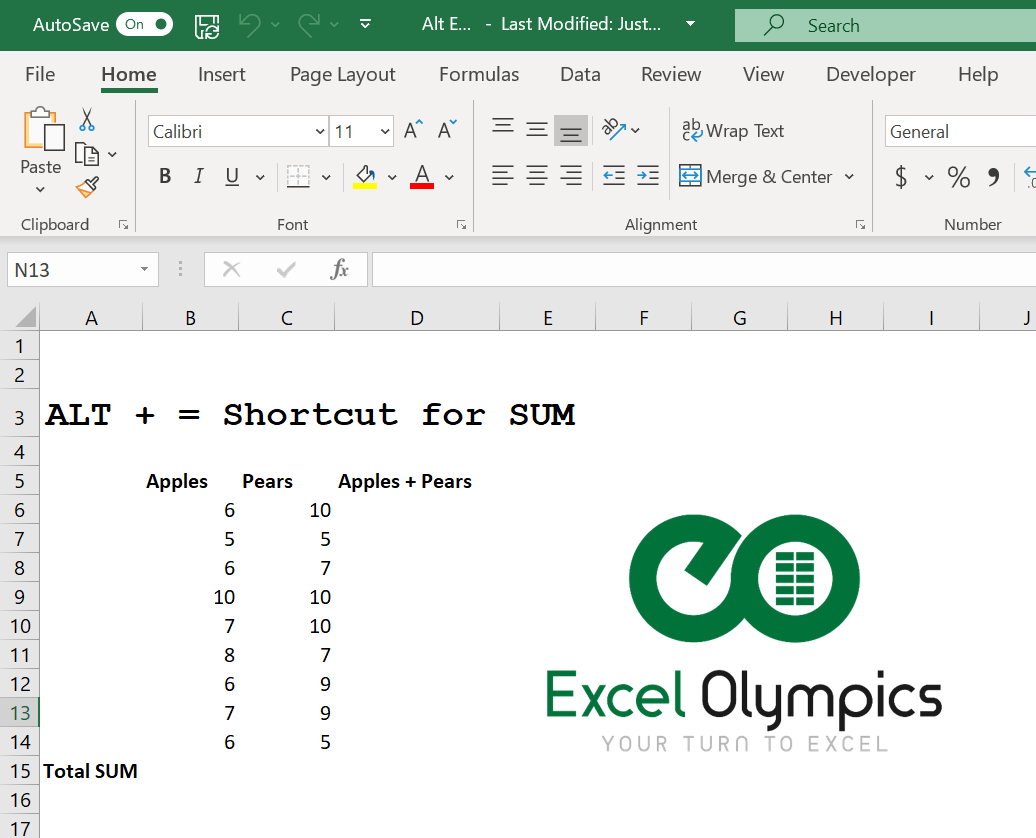

4. Calculate Total Direct and Indirect Costs

Sum the costs for direct and indirect in separate cells using the SUM function:

- Total Direct Costs = SUM(B2:B7)

- Total Indirect Costs = SUM(C2:C7)

5. Apply the Formula

To calculate the indirect cost rate, in an empty cell:

= (Total Indirect Costs / Total Direct Costs) * 100

💡 Note: Make sure to reference the cells where your totals are calculated rather than typing the numbers directly.

6. Format as Percentage

To display the result as a percentage, right-click on the cell with the formula, select “Format Cells,” and under the “Number” tab, choose “Percentage” with two decimal places.

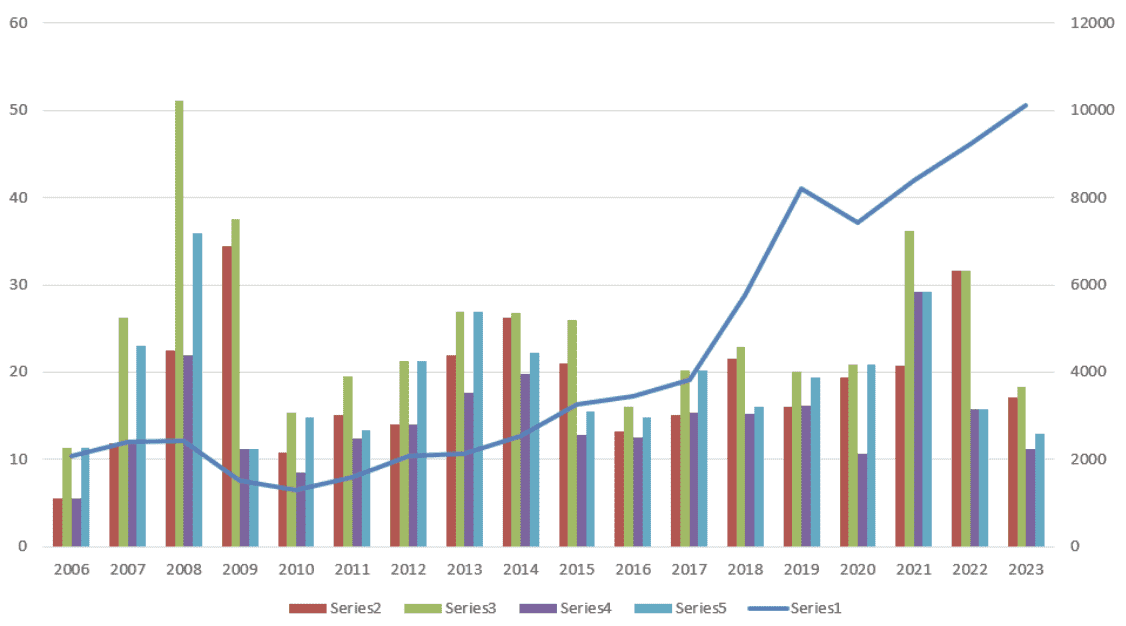

7. Sensitivity Analysis

Optional but useful, you can use Excel’s tools like:

- Data Table for different scenarios.

- Goal Seek to find out how changes in direct or indirect costs affect the rate.

- What-If Analysis to model various financial conditions.

Applying the Indirect Cost Rate

Once you have the indirect cost rate, you can:

- Add this percentage to the direct costs of projects for budgeting or pricing purposes.

- Use it in grant applications where a specific rate or justification is needed.

📝 Note: The indirect cost rate can change over time due to changes in indirect or direct costs, so regular updates are necessary.

In summary, the calculation of the indirect cost rate in Excel involves listing out your direct and indirect expenses, totaling them up, and then applying the formula. This rate is essential for any business to ensure that all costs are accounted for in pricing and budgeting, ensuring both transparency and financial health. By following these steps, businesses can more accurately reflect their operational costs, which in turn supports better decision-making and financial reporting.

What if my indirect costs are higher than my direct costs?

+If indirect costs exceed direct costs, it’s an indication that a significant portion of your business’s expenses are not tied to specific projects or products. This might affect your pricing strategy, as you’ll need to recover these costs through indirect methods like overhead charges or general service fees.

Can I use this rate for all types of projects?

+While this rate can be applied generally, some funding bodies or contracts might have restrictions or different methods for calculating indirect costs. Always review specific guidelines or agreements before applying the rate universally.

How often should I recalculate my indirect cost rate?

+It’s advisable to review and potentially recalculate your indirect cost rate annually or whenever there are significant changes in your business operations, costs, or funding requirements.

Related Terms:

- indirect cost calculation example

- indirect cost rate calculation example

- indirect cost calculator ultra

- actual indirect cost rate formula

- how are indirect costs calculated

- indirect cost calculator online