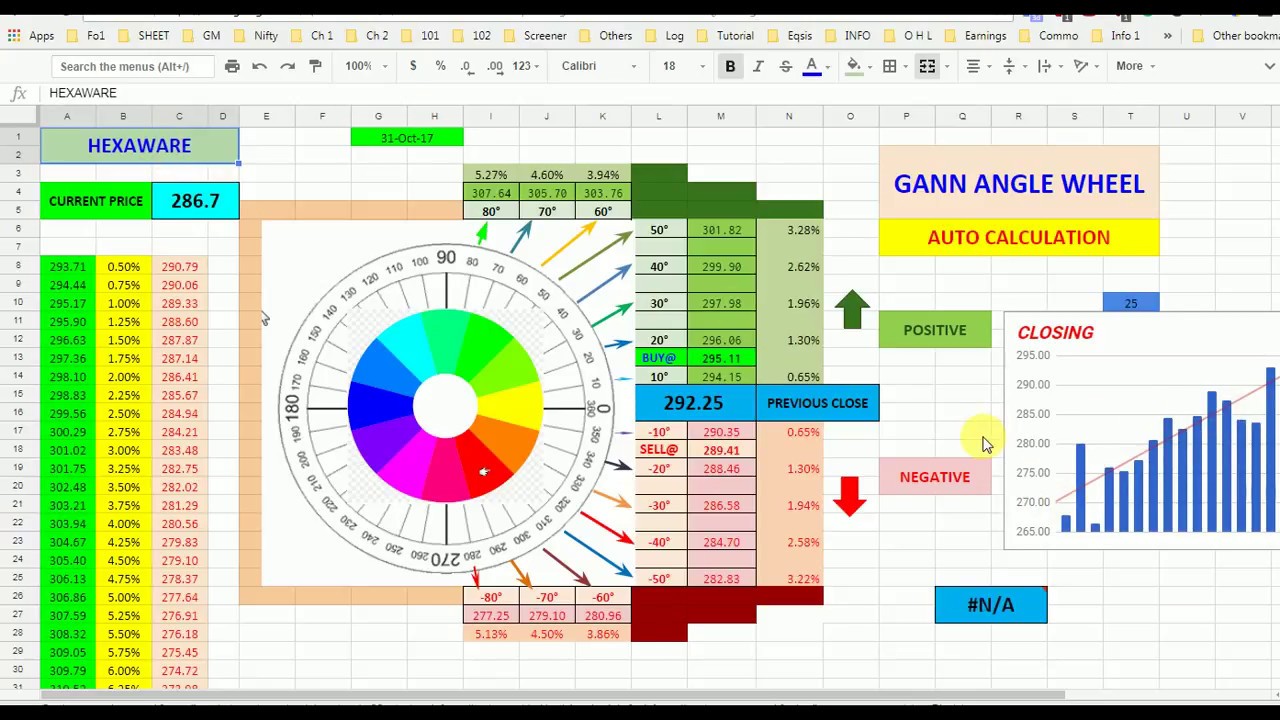

Gann Calculator Excel Sheet & Angle Wheel Download

The realm of technical analysis offers numerous tools to traders and investors seeking to predict market movements with greater accuracy. Among these tools, the Gann Calculator stands out for its unique approach based on the principles laid down by the legendary trader, W.D. Gann. Understanding and applying Gann theory through tools like the Gann Calculator Excel Sheet and the Angle Wheel can potentially enhance your trading strategies. Here, we'll delve into what these tools are, how to use them, and why they could be integral to your trading toolkit.

What is a Gann Calculator?

A Gann Calculator, often referred to as a Gann Square or Gann Wheel, is a mathematical tool designed to identify potential future price levels based on historical price data. W.D. Gann, who developed this tool, believed in the law of vibration which posits that markets move in predictable patterns governed by time and price cycles.

- Geometric Patterns: Gann theorized that markets follow geometric patterns, which can be expressed mathematically.

- Time and Price Relationship: Gann believed there is a direct relationship between time and price, with specific ratios dictating movement.

💡 Note: While Gann’s principles are rooted in mathematics, traders should use them as part of a comprehensive analysis strategy rather than relying on them exclusively.

Components of a Gann Calculator

The Gann Calculator typically includes several components:

| Component | Description |

|---|---|

| Gann Square | A grid where price and time intersect, highlighting potential support and resistance levels. |

| Angle Wheel | A circular chart showing Gann angles, which are lines drawn at specific angles that represent market trends and speed of price movement. |

How to Use the Gann Calculator Excel Sheet

Using the Gann Calculator Excel sheet involves setting up your Excel environment and understanding how to input and analyze data:

- Preparation: Open your Excel sheet, which should contain columns for Date, Open, High, Low, and Close prices of a financial instrument.

- Setup:

- Label a cell as “Pivot” to hold your base or pivot price, which you choose based on significant highs or lows in the market.

- Create columns for different Gann angles such as 1x1, 1x2, 1x4, 2x1, and 4x1, where each number represents the ratio of time to price movement.

- Input Data:

- Enter the price data from your trading platform into the Excel sheet.

- Calculate Gann Angles:

- Set up formulas or use existing Gann calculators within Excel to calculate the Gann angles from your pivot point.

📝 Note: Accurate historical data is crucial for precise Gann analysis.

Understanding the Gann Angle Wheel

The Gann Angle Wheel provides a visual representation of how price might move over time. Here’s how to interpret it:

- Angle 1x1: Represents one unit of price for one unit of time. It signifies a 45-degree angle where price and time have a 1:1 relationship.

- Steeper or Flatter Angles: Angles like 2x1 or 4x1 indicate a faster or slower rate of price movement relative to time.

Using the Gann Angle Wheel:

- Plot the Wheel: Center the wheel at a significant price level or pivot point.

- Identify Key Angles: Draw lines from this center along each Gann angle to the future time periods.

- Price Support/Resistance: Where these lines intersect with future dates can act as potential support or resistance zones.

Integrating Gann Calculator and Angle Wheel into Trading Strategy

Incorporating Gann tools into your trading strategy requires:

- Historical Analysis: Look for recurring patterns using past price data.

- Time Cycles: Utilize Gann’s square of nine and other time cycles to forecast future market turns.

- Confirmation with Other Indicators: Use traditional indicators like RSI, MACD, or moving averages to confirm signals from Gann tools.

Here’s how you might combine these tools:

- Entry Points: Identify where the current price is in relation to Gann angles and support/resistance levels derived from the calculator.

- Exit Strategy: Use the Angle Wheel to project potential price targets for exiting trades.

- Risk Management: Set stop-losses at levels where Gann analysis suggests potential reversals or failures of support/resistance.

🎯 Note: Gann analysis should complement, not replace, other forms of analysis and risk management strategies.

Challenges and Limitations of Gann Analysis

Despite its appeal, Gann analysis has its challenges:

- Subjectivity: The interpretation of Gann angles can vary, leading to inconsistent trading decisions.

- Market Noise: Real market conditions often present noise that can obscure clear Gann-based signals.

- Complex Calculation: Properly setting up and maintaining Gann calculations in Excel can be time-consuming and error-prone.

Recapitulation

Understanding and using the Gann Calculator Excel Sheet and the Angle Wheel provides traders with a unique perspective on market movements, based on the mathematical theories of W.D. Gann. These tools help identify potential support and resistance levels, project future price movements, and incorporate time into trading strategies. However, they are not infallible and should be used with other technical and fundamental analysis techniques. The key to effectively trading with Gann tools lies in a disciplined approach, consistent application, and continuous learning.

Can Gann Calculator be used for intraday trading?

+

Yes, Gann Calculators can be adapted for intraday trading by using smaller time increments for plotting angles and calculating price movements. However, the market noise and rapid price changes make intraday Gann trading more challenging.

How accurate are Gann predictions?

+

The accuracy of Gann predictions varies based on market conditions, the trader’s interpretation, and the integration with other forms of analysis. While some traders find significant value, there’s no universal accuracy rate for Gann analysis.

What are the best practices for using Gann tools effectively?

+

Best practices include using Gann tools as part of a broader analysis strategy, regularly backtesting predictions, adjusting for market volatility, and combining Gann with other technical indicators for signal confirmation.

Related Terms:

- Gann Hexagon Chart Excel download

- Gann Wheel of 24 excel

- Gann time cycle calculator

- Gannzilla calculator

- Gann Square of 9 calculator

- gann excel sheet download