5 Essential Excel Templates for Safal Niveshak Investors

Excel is an incredibly powerful tool for investors, offering the ability to track, analyze, and optimize investment portfolios. Whether you're a novice looking to get started or a seasoned investor aiming to refine your strategies, utilizing the right Excel templates can significantly enhance your investment journey. Here's a look at five essential Excel templates tailored for investors aligned with the principles of Safal Niveshak - an investment philosophy centered around long-term value investing, insightful analysis, and disciplined investing habits.

1. Investment Portfolio Tracker

This template is the cornerstone for any investor. It provides a clear and comprehensive view of your investment holdings:

- Portfolio Overview: A dashboard displaying total investment, value, gain/loss, and overall return.

- Transaction History: Records of buy/sell transactions with dates, quantities, and prices.

- Asset Allocation: Detailed breakdown by asset class, sector, or geography.

- Performance Analysis: Calculations for ROI, CAGR, and Sharpe Ratio to assess performance.

⚠️ Note: Regularly updating your portfolio tracker ensures real-time insights into your investment health. Always cross-check figures with brokerage statements.

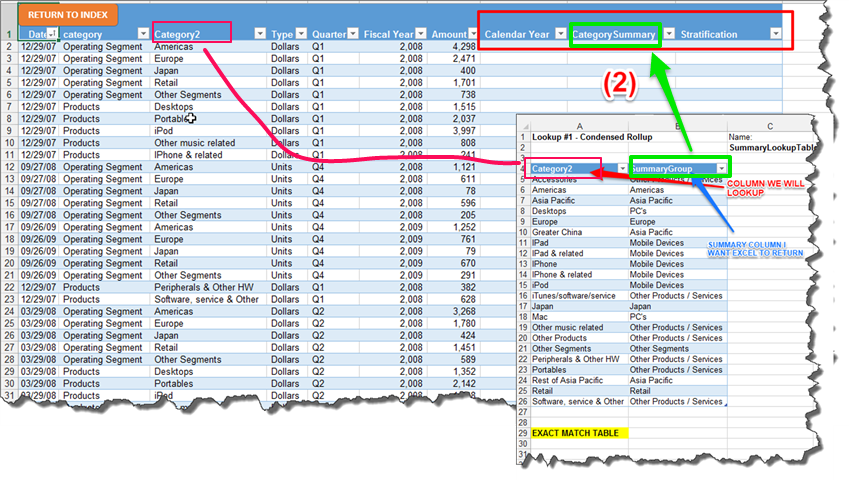

2. Stock Valuation Model

Valuing stocks accurately is crucial for making informed investment decisions. This template helps in:

- Discounted Cash Flow (DCF) Analysis: Calculates the present value of future cash flows.

- Relative Valuation: Compares the stock’s metrics (like P/E, P/B ratios) with industry averages or competitors.

- Sensitivity Analysis: Assesses how changes in key assumptions affect valuation.

📊 Note: The stock valuation model is only as good as the assumptions you input. It's important to use conservative estimates and review assumptions regularly.

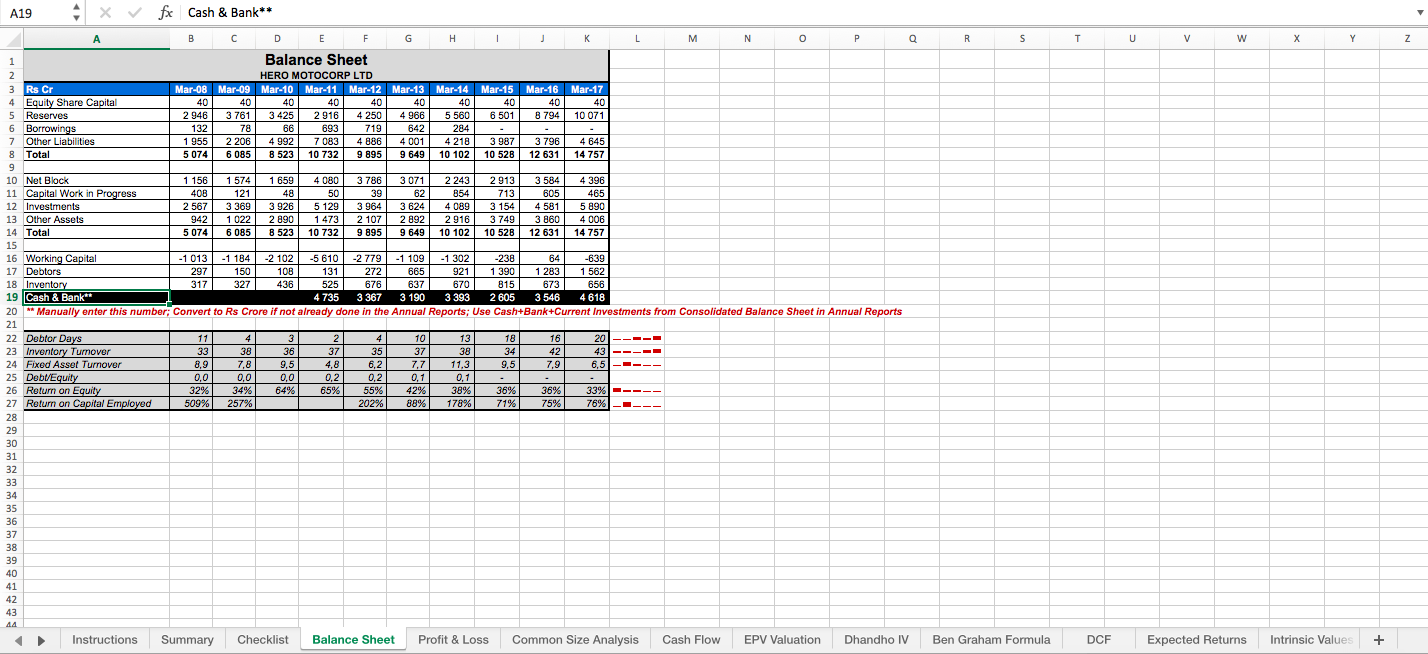

3. Financial Ratios Dashboard

To understand a company’s financial health, ratios are indispensable. This template features:

- Profitability Ratios: ROE, ROA, Net Profit Margin.

- Efficiency Ratios: Inventory Turnover, Receivables Turnover.

- Liquidity Ratios: Current Ratio, Quick Ratio.

- Leverage Ratios: Debt to Equity, Interest Coverage.

🔍 Note: Ratios provide insights but should be used in conjunction with qualitative analysis of the company's business model and market conditions.

4. Investment Goal Planner

Setting and tracking investment goals is fundamental to success:

- Goal Setting: Define your financial goals, timelines, and expected returns.

- Savings Schedule: Monthly or yearly savings plans to meet those goals.

- Risk Assessment: Evaluate the level of risk you’re willing to take to reach your investment objectives.

5. Dividend Reinvestment Calculator

The power of compounding through dividend reinvestment can significantly boost long-term wealth:

- Dividend Tracking: Logs dividends received, their reinvestment, and share quantities.

- Future Projections: Estimate future value with reinvestment at different growth rates.

💡 Note: Ensure the accuracy of reinvested dividends by regularly checking with your brokerage statements.

In this overview, we've explored five Excel templates critical for investors following the principles of Safal Niveshak. These tools not only help in managing your portfolio but also in making informed decisions aligned with a long-term, value-focused investment strategy. Utilizing these templates can streamline your investment process, giving you the analytical edge needed to grow your wealth wisely.

How often should I update my Investment Portfolio Tracker?

+It’s advisable to update your tracker monthly or after significant transactions to reflect your current investment position accurately.

Can I customize these Excel templates to fit my specific needs?

+Yes, Excel templates are highly customizable. You can adjust formulas, add new columns, or change the layout to suit your investment style.

What if I’m not familiar with financial ratios?

+Financial ratios can seem complex at first, but educational resources and financial literacy courses can help demystify them. Start with common ratios and build your knowledge over time.