Calculate Payback Period Easily in Excel

The payback period is a fundamental financial metric used by businesses and investors to evaluate the time it will take for an investment to generate enough cash flow to recover the initial investment cost. While it does not consider the time value of money, it remains a popular tool due to its simplicity and directness in measuring liquidity risk. This blog post will guide you through the process of calculating the payback period using Microsoft Excel, providing you with a step-by-step approach that can be adapted to various financial scenarios.

Understanding the Payback Period

Before diving into Excel calculations, it’s crucial to understand what the payback period signifies:

- Investment Recovery Time: How long it will take to get back the amount initially invested in a project.

- Risk Assessment: Shorter payback periods are often associated with lower risk, as the investment is recovered more quickly.

- Decision Making: Helps in comparing different investment options or projects based on liquidity.

Setting Up Your Excel Workbook

Let’s begin with setting up your workbook:

- Create a new workbook: Open Excel and create a blank worksheet.

- Label Columns: In the first row, label columns as follows:

- Year/Period

- Initial Investment

- Cash Flow

- Cumulative Cash Flow

- Payback (Years/Periods)

- Enter Data: Input the time period, initial investment, and projected annual cash flows.

Here’s an example table to illustrate:

| Year/Period | Initial Investment | Cash Flow | Cumulative Cash Flow | Payback (Years/Periods) |

|---|---|---|---|---|

| 0 | -50,000</td> <td>0 | -50,000</td> <td>0</td> </tr> <tr> <td>1</td> <td>0 | 10,000</td> <td>-40,000 | |

| 2 | 0</td> <td>15,000 | -25,000</td> <td></td> </tr> <tr> <td>3</td> <td>0 | 20,000</td> <td>-5,000 | |

| 4 | 0</td> <td>25,000 | $20,000 |

💡 Note: In the table above, we consider each row as a period. For simplicity, years are used, but you can adapt this to any time frame.

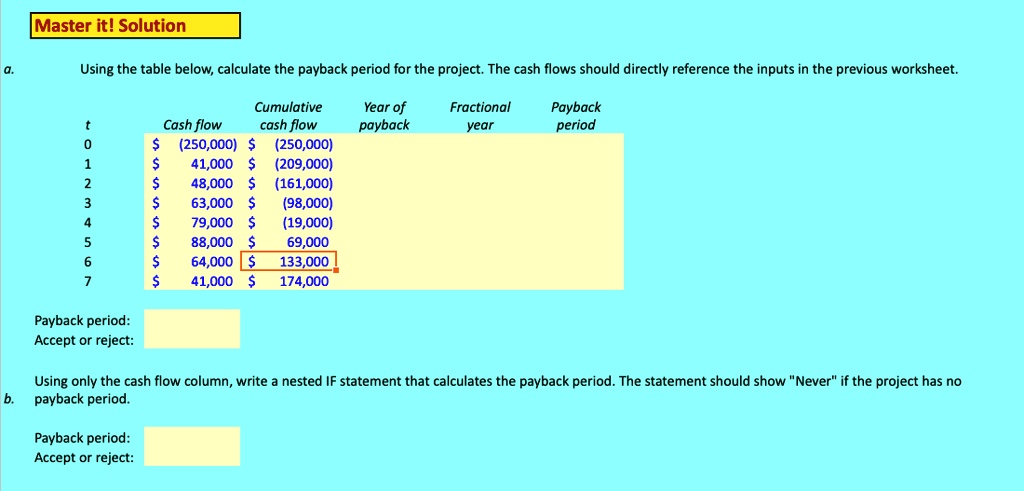

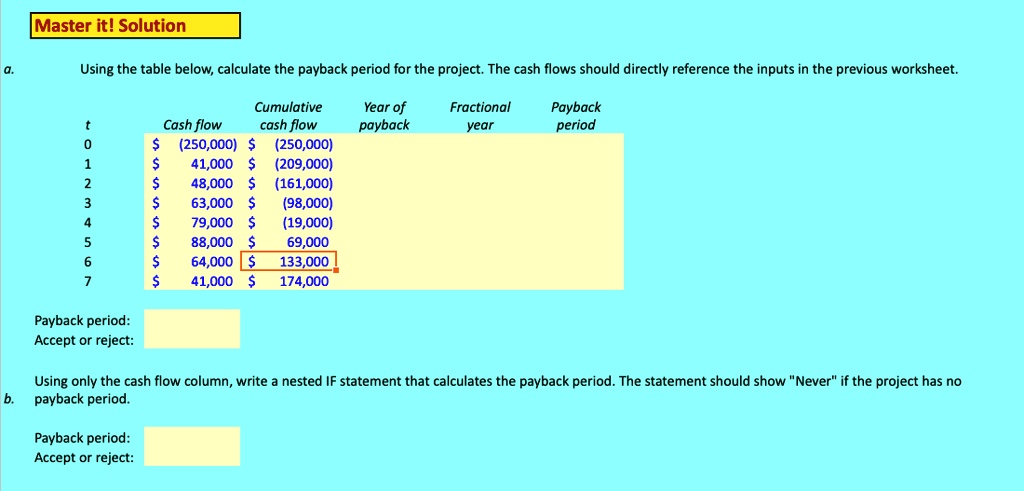

Calculating Payback Period in Excel

Now that the groundwork is laid, here’s how to calculate the payback period:

Step 1: Sum Up Cash Flows

Insert a formula in column D to calculate the cumulative cash flow. For example, in cell D2, you would enter:

=B2+C2

Then, drag this formula down the column for subsequent rows:

=D2+C3

Continue this pattern for all rows.

Step 2: Calculate Payback Periods

In the Payback (Years/Periods) column, you’ll determine when the cumulative cash flow becomes positive. Here’s how:

- In cell E1, enter “0” since the payback period is 0 initially.

- For subsequent rows, check if the cumulative cash flow is still negative:

=IF(D3<0, D2, D2)

- When the cumulative cash flow turns positive or reaches 0, calculate the payback period:

=IF(D3>=0, ROW()-ROW(E$1)+MIN(E2,E3), D2)

🚫 Note: The formula accounts for fractional periods by considering partial recoveries if the exact payback period falls between two periods.

Interpreting the Payback Period

After running these calculations, Excel will indicate the payback period in the relevant cells. Here’s what to look for:

- Full Recovery: If the cumulative cash flow goes positive before the end of the investment’s life, the cell will show a specific number indicating the payback period.

- Partial Recovery: If the cumulative cash flow remains negative at the end of the projected period, the payback period is not yet achieved.

- Fractional Period: If the initial investment is recovered during a specific year, the cell may show a decimal, representing the portion of that year.

Using Excel Functions for Complex Scenarios

For more complex scenarios or to incorporate the time value of money, consider these functions:

- XNPV: To calculate the net present value of cash flows with varying time periods.

- XIRR: For internal rate of return when cash flows occur irregularly.

📊 Note: Using these functions, you can adjust the payback period calculation to include discounted cash flows, offering a more accurate assessment for investments with longer time horizons.

Limitations of Payback Period

While the payback period is useful, it has several limitations:

- Ignores Time Value of Money: It does not discount future cash flows back to the present, which can underestimate the value of long-term investments.

- Does Not Consider Profitability: It only focuses on the recovery of the initial investment, not on the profit generated beyond that point.

- Assumes Even Cash Flows: If cash flows are irregular or change drastically over time, the payback period calculation becomes less reliable.

Wrapping up, understanding and calculating the payback period through Excel provides a valuable snapshot of an investment's liquidity. Despite its limitations, this method offers a straightforward approach to compare investment recovery times, helping decision-makers to evaluate the risk associated with capital investments. By setting up your Excel sheet as outlined above, you can quickly analyze different scenarios, adjust for various cash flow patterns, and make informed financial decisions. Keep in mind the strengths and weaknesses of the payback period to ensure your financial analysis remains robust and well-rounded, considering other financial metrics where necessary.

What if my cash flows are not yearly?

+

You can still calculate the payback period by adjusting the time periods in Excel. Just ensure your cash flows are aligned with the actual intervals at which they occur, whether it’s monthly, quarterly, or any other frequency.

How accurate is the payback period for long-term investments?

+

The payback period can be less accurate for long-term investments as it doesn’t account for the time value of money, which becomes increasingly significant over extended time frames. For more precise evaluations, consider using NPV or IRR alongside the payback period.

Can I calculate payback periods for multiple projects in the same Excel sheet?

+

Yes, you can set up multiple columns or worksheets for each project, allowing you to compare payback periods side by side or summarize them in a master table for decision-making purposes.

Related Terms:

- Payback period calculator

- Payback period adalah

- Rumus Payback Period Excel

- Discounted payback period formula

- Payback Period Excel template download

- IRR calculator