5 Tips for ABA Business Financial Projections in Excel

Financial projections are the backbone of any business plan, providing a roadmap to success and a clear vision for growth. When it comes to Applied Behavior Analysis (ABA) businesses, where forecasting can be particularly challenging due to the unique nature of the services, mastering financial projections in Excel becomes even more critical. Here, we'll delve into five essential tips to make your ABA business financial projections both accurate and effective, using Excel.

1. Start with a Solid Foundation

Before diving into complex projections, ensure you have a robust base from which to build:

- Historical Data: If your business already operates, review your financial history. This includes revenue, expenses, staff costs, and client acquisition costs. Use Excel’s SUMIF or AVERAGEIF functions to analyze trends.

- Market Research: Understand your market size, growth rates, and competition. Incorporate this data into your projections using pivot tables for clarity.

- Service Specifications: Clearly define what services you’ll offer, your pricing strategy, and any seasonal fluctuations in demand. Use Excel’s conditional formatting to highlight areas of potential variance.

💡 Note: Ensure all your initial data is accurate as this forms the baseline for all future projections.

2. Understand Your Cost Structure

ABA businesses have specific cost drivers that should be accurately forecasted:

- Direct Costs: Costs directly associated with delivering ABA services, such as therapist wages, clinical materials, and rent for therapy rooms. Use Excel’s VLOOKUP to automatically adjust these costs based on different scenarios.

- Fixed Costs: Costs like administrative salaries, rent, utilities, and insurance. These can be entered directly or linked to external sources.

- Variable Costs: Costs like travel expenses, session materials, and some indirect client costs. These can be modeled with Excel’s LINEST or FORECAST functions to predict future changes.

⚠️ Note: Incorrectly estimating variable costs can significantly skew your profitability projections.

3. Craft Detailed Revenue Forecasts

Revenue projections are the cornerstone of your financial plan:

- Client Acquisition: Estimate the number of new clients per month using Excel’s GROWTH or TREND functions, based on marketing strategies and historical data.

- Retention Rates: Model client retention using historical data and incorporate assumptions about client lifetime value. Use Excel’s IRR function for this analysis.

- Pricing Models: Evaluate different pricing strategies (hourly rates, package deals, or subscriptions). Use scenario analysis in Excel to see how different pricing strategies affect revenue.

💡 Note: Don’t forget to account for third-party payments, insurance, or educational funding, which might influence your revenue stream.

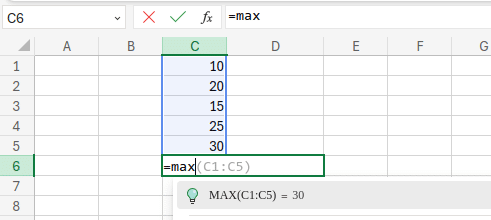

4. Employ Advanced Excel Functions

Excel’s capabilities are vast; here’s how to leverage them for projections:

- Data Tables: Use data tables for what-if analysis on variables like client numbers, pricing, and costs.

- Goal Seek: Understand how changes in any variable impact your financial goals. For instance, if you need a specific net income, Goal Seek can show what pricing or client acquisition rates you need.

- Scenarios: Create scenarios to visualize different business outcomes. Use Excel’s Scenario Manager to manage multiple projections.

5. Regularly Revisit and Adjust Projections

Projections are dynamic; your business will evolve:

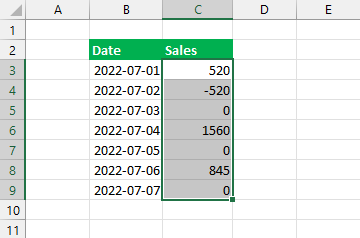

- Track Actuals vs. Forecast: Create a dashboard to compare forecasted figures against actual financial performance. Use Excel’s pivot charts for a visual representation.

- Adjust Assumptions: Regularly update your assumptions based on market feedback, competitor actions, or internal changes. Employ Excel’s Named Ranges to update variables easily.

- Forecast Accuracy: Use Excel’s Forecast Sheet feature to predict future trends based on historical data, adjusting projections accordingly.

In conclusion, financial projections for ABA businesses require a deep understanding of not only Excel but also the unique variables of the ABA industry. By establishing a strong foundation, accurately mapping out your cost structure, crafting detailed revenue forecasts, using Excel’s advanced functions, and regularly revisiting your projections, you can ensure your financial planning is both realistic and strategic. This proactive approach will not only guide your business decisions but also impress potential investors or partners with your commitment to financial foresight.

What are the benefits of using Excel for financial projections?

+Excel offers versatility and robustness in handling complex calculations, data analysis, and what-if scenarios. Its extensive functionality allows for customized forecasting, integration with other data sources, and can help in making data-driven decisions.

How do I account for the unpredictability of client sessions in ABA?

+Use conservative estimates for session frequency, employ a range of scenarios to accommodate variability, and regularly update your data with actual client session outcomes.

Can Excel handle changes in insurance billing for ABA services?

+Absolutely. By setting up tables or databases within Excel, you can simulate various billing scenarios, reflecting how changes in insurance policies or rates might affect revenue.

What tools in Excel are best for financial modeling in ABA?

+Pivot tables, conditional formatting, VLOOKUP, LINEST, FORECAST, Scenario Manager, Goal Seek, and Data Tables are among the most useful tools for financial modeling in Excel.

How often should I update my financial projections?

+Regular updates are crucial. Consider monthly reviews with quarterly or annual deeper analyses to adjust for any significant changes in your business environment or performance.

Related Terms:

- financial projection examples

- annual projection template excel

- financial projections for startups

- annual financial projection template

- 12 month financial projection template

- financial projection template for startup