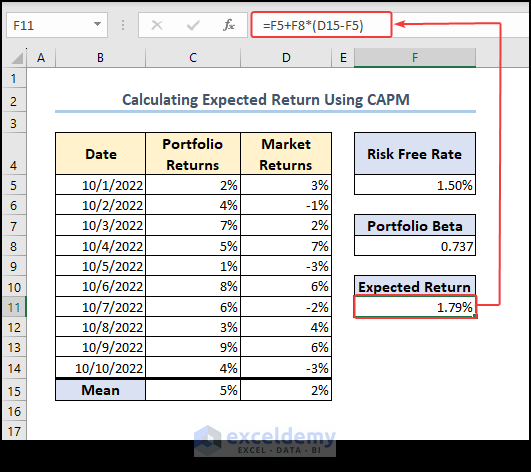

3 Simple Steps to Calculate Beta in Excel

Understanding Beta

Beta is a key metric used in finance to measure the volatility, or systematic risk, of an individual stock or portfolio in comparison to the broader market. Typically, the market, represented by major indices like the S&P 500, has a beta of 1.0. Stocks or portfolios with a beta greater than 1 are considered more volatile than the market, while those below 1 are less volatile. Here are the steps to calculate beta in Excel:

Step 1: Gather Historical Data

Begin by collecting historical price data for both the stock in question and the benchmark index:

- Stock Prices: You’ll need the daily, weekly, or monthly closing prices for the stock.

- Market Index Prices: Similarly, gather the closing prices for the market index you’re comparing against, such as the S&P 500.

These prices should cover the same time period and ideally, include at least one to three years of data to provide a robust dataset.

Step 2: Calculate Returns

Calculate the logarithmic returns or percentage changes for both the stock and the market:

- Stock Return: Use Excel’s

LN(Current Price/Previous Price). - Market Return: Similarly, apply this to the market index data.

The logarithmic returns help in smoothing out compounding effects and provide a more accurate view of returns over time.

Sample Table:

| Date | Stock Price | Market Price | Stock Return | Market Return |

|---|---|---|---|---|

| 1-Jan-2022 | 100 | 3000 | - | - |

| 2-Jan-2022 | 102 | 3010 | 0.019803 | 0.003333 |

| 3-Jan-2022 | 98 | 3020 | -0.040000 | 0.003333 |

📝 Note: The first row for returns will be blank as there is no previous price to calculate return from.

Step 3: Compute Beta Using Regression Analysis

After computing returns, the next step is to perform a regression analysis:

- In Excel, go to the “Data” tab and choose “Data Analysis.”

- Select “Regression” from the list of analysis tools.

- Set your stock returns as the Y variable (dependent variable) and the market returns as the X variable (independent variable).

- The output will include the slope of the regression line, which is the Beta coefficient.

Here’s an example of what the regression output might look like:

SUMMARY OUTPUT

Regression Statistics

Multiple R: 0.75

R Square: 0.56

Adjusted R Square: 0.54

Standard Error: 0.03

ANOVA

Regression

Residual

Total

Coefficients

Intercept: 0.003

X Variable: 1.345

The beta value here is 1.345, indicating that the stock is about 35% more volatile than the market.

The above steps provide a practical approach to calculating beta in Excel. By understanding beta, investors can make informed decisions about risk exposure and potential stock performance relative to market movements. Keep in mind that beta does not capture all risks (like company-specific events) but gives a solid foundation for understanding how stocks might move with market trends.

As you continue to navigate the complexities of investing, remember that tools like Excel can simplify complex financial analyses. Beta analysis is a starting point; consider other financial metrics and qualitative factors before making investment decisions.

Why is logarithmic return preferred over simple return?

+Logarithmic returns provide a better approximation of the geometric growth rates of investments and are preferred in financial calculations because they are additive over time, making compounding effects easier to analyze.

Can beta be negative?

+Yes, though rare, beta can be negative. This implies that the stock moves in the opposite direction of the market. However, it’s more common for betas to be low positive values or very rarely, negative values.

How often should beta be recalculated?

+Beta should be recalculated periodically as market conditions and company-specific factors change. For most practical purposes, recalculating beta quarterly or annually provides a good balance of being up-to-date while accounting for market trends.

Related Terms:

- Beta calculation Excel template

- Beta calculator

- Beta in Excel symbol

- Portfolio beta Excel

- levered beta formula excel

- beta calculation excel template