Excel Template for Kentucky Tobacco Tax Savings

Kentucky Tobacco Tax Savings - Excel Template Guide

Introduction to Kentucky Tobacco Tax Savings

Kentucky, like many other states in the U.S., imposes specific excise taxes on tobacco products to discourage use, raise revenue, and address public health issues. However, for tobacco wholesalers, retailers, and manufacturers, understanding and optimizing these taxes can lead to significant savings. This article provides an in-depth guide on utilizing an Excel template for Kentucky Tobacco Tax Savings, crafted to assist those involved in the tobacco industry in calculating and managing their taxes efficiently.

Understanding Kentucky Tobacco Tax Structure

The state of Kentucky applies a tax on tobacco products at both the federal and state levels. Here’s a simplified structure:

- Federal Excise Tax - Applied to every pack of cigarettes and specific per-unit taxes for other tobacco products.

- State Excise Tax - Kentucky’s specific tax on cigarettes, cigars, and other tobacco products, including the Master Settlement Agreement tax.

- Master Settlement Agreement (MSA) Tax - Additional payment related to the MSA signed between states and tobacco companies.

📌 Note: For exact tax rates and detailed descriptions, consult the Kentucky Department of Revenue website.

Creating an Excel Template for Tax Calculation

To manage Kentucky tobacco tax effectively, an Excel template can be a powerful tool. Here’s how to set it up:

Step-by-Step Guide to Set Up

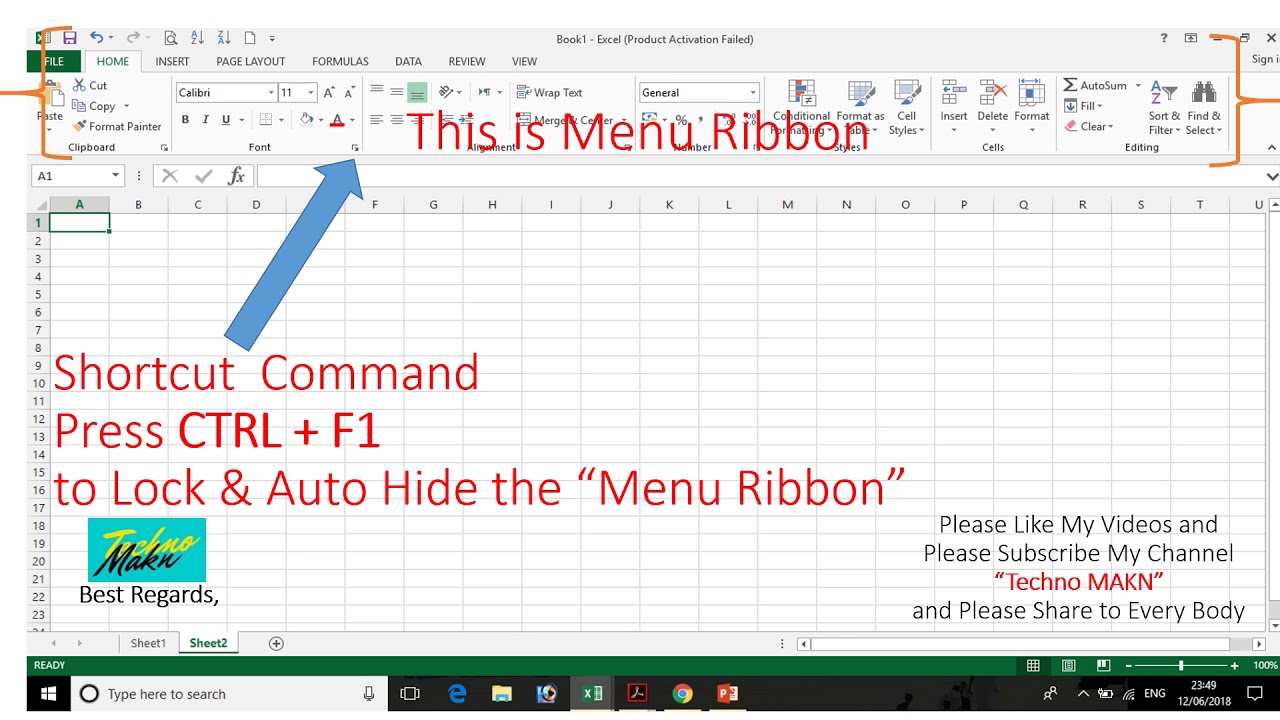

Here’s how to create an Excel template for calculating Kentucky tobacco tax:

- Open a New Excel Workbook

- Define Headers - Set up columns for product type, unit of measure, quantity, federal tax, state tax, MSA tax, and total tax.

- Enter Product Details - List all tobacco products sold, categorized by type.

- Input Tax Rates - Enter tax rates for each product type and tax category.

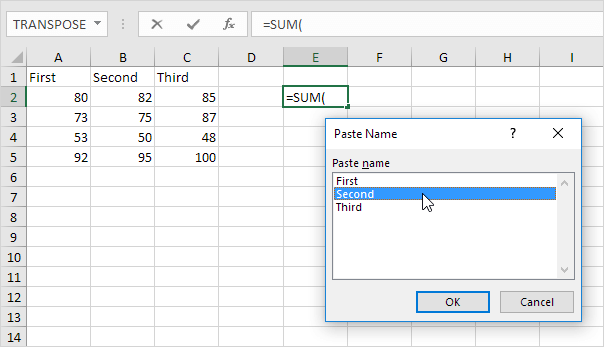

- Calculate Taxes - Use formulas to calculate taxes based on quantity and tax rates. For example:

Where B2 is quantity, C2 is federal tax, D2 is state tax, and E2 is MSA tax.=B2*(C2+D2+E2) - Summarize Total Tax - Use SUM function for total tax.

- Finalize and Save - Review, format for clarity, and save your template.

| Product Type | Unit of Measure | Quantity | Federal Tax | State Tax | MSA Tax | Total Tax |

|---|---|---|---|---|---|---|

| Cigarettes | Pack | 1000 | $1.01 | $0.60 | $0.02 | $1630.00 |

| Cigars | Piece | 500 | $2.75 | $0.25 | $0.05 | $1650.00 |

💡 Note: Ensure tax rates are updated regularly to reflect changes in legislation or MSA payments.

Strategies for Tax Optimization

Here are several strategies to optimize your tobacco tax liability in Kentucky:

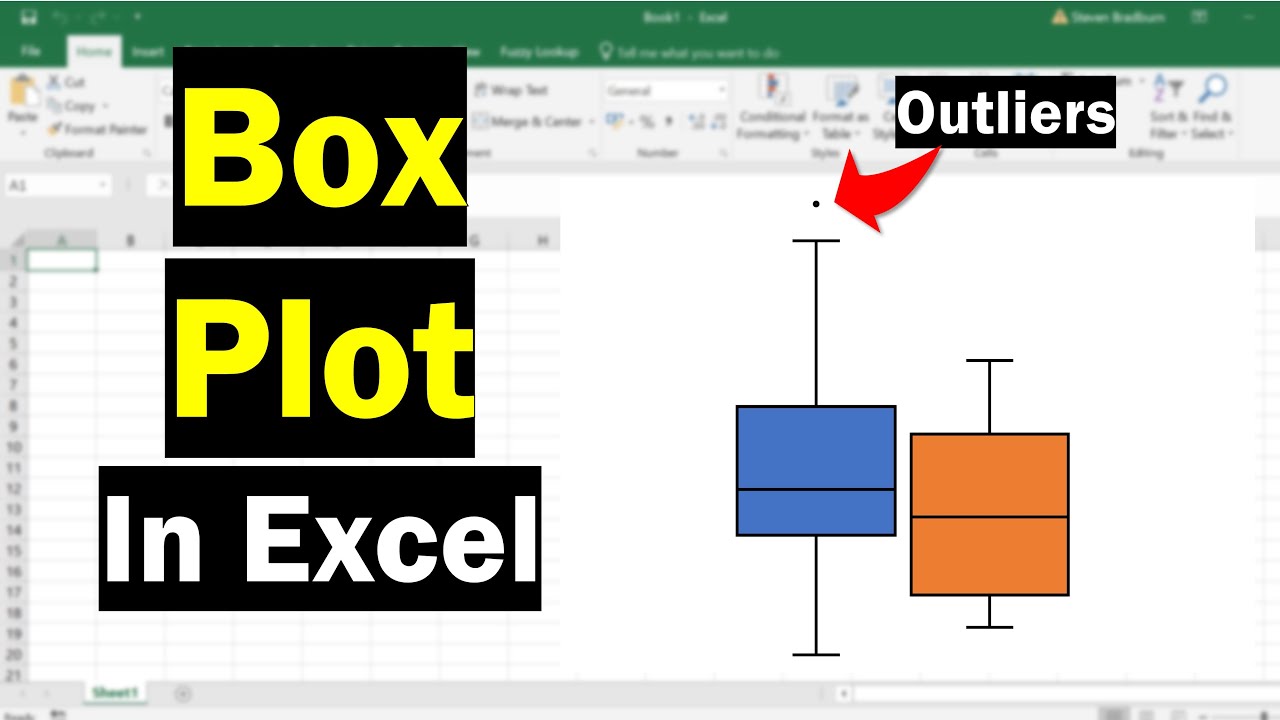

- Proper Inventory Management - Track your inventory to avoid overstocking, which could lead to higher tax liability.

- Monitor Changes in Legislation - Regularly review tax laws to preemptively adjust your business practices.

- Leverage Tax Exemptions - Explore exemptions, especially for products intended for export or specific uses.

- Bulk Purchasing - Consider bulk purchasing to reduce per-unit cost, potentially offsetting tax rates.

🌟 Note: Implementing these strategies requires precise record-keeping, which your Excel template can facilitate.

Regulatory Compliance

When dealing with tobacco taxes, compliance with state and federal regulations is paramount:

- Accurate Tax Filing - Report all tobacco sales accurately, utilizing your Excel template for calculations.

- Audit Readiness - Be prepared for audits by keeping detailed records, both in physical form and backed up electronically.

- Stamps and Seals - Ensure all cigarettes have the required tax stamps, which can be tracked in your inventory spreadsheet.

- Staying Informed - Subscribe to newsletters or updates from the Kentucky Department of Revenue to stay informed of changes.

📍 Note: Failure to comply can result in significant penalties. Maintain diligence.

Utilizing an Excel template for managing Kentucky Tobacco Tax Savings not only simplifies the process of calculating taxes but also provides a structured approach to optimizing your tax liability. Understanding the tax structure, creating an accurate template, and employing effective tax strategies can lead to significant financial benefits for businesses involved in the tobacco trade.

How often should I update my Excel template with tax rates?

+Check for updates quarterly or when new legislation is announced, to ensure your template reflects the most current tax rates.

Can I use this template for other states?

+The template can be adapted for other states, but you would need to modify tax rates and structure to comply with their specific regulations.

What if I make a mistake in my tax filing?

+Amend your tax return as soon as possible. If you’ve overpaid, you can file for a refund; if underpaid, expect to pay the additional tax plus interest and potential penalties.

Is there a way to automate my tax calculations further?

+Yes, by integrating your Excel template with accounting software or using specialized tax software, you can automate many processes involved in tax calculations.

Related Terms:

- Kentucky withholding tax table 2024

- Kentucky local income tax withholding

- k-1 kentucky withholding form

- Kentucky local income Tax Lookup

- Kentucky income tax calculator

- Kentucky W2 Form