5 Excel Tips from Wall Street Prep

Wall Street Prep is renowned for providing high-quality financial modeling training to students, professionals, and corporations globally. Excel, being the cornerstone of financial analysis, is heavily utilized in their courses. Here are five Excel tips inspired by Wall Street Prep that can significantly enhance your spreadsheet skills:

1. Mastering Keyboard Shortcuts

Wall Street Prep emphasizes the importance of keyboard shortcuts for efficiency. Here are some shortcuts that can speed up your work:

- Ctrl + Arrow Keys: Navigate quickly to the edges of data sets.

- Alt + E, S, V: Open the Paste Special dialog quickly.

- Ctrl + Shift + Enter: Enter an array formula.

- Alt + W, V: Toggle View Side by Side for comparing sheets.

✍️ Note: Learning these shortcuts can dramatically reduce the time spent on routine tasks, allowing you to focus more on analysis and less on navigation.

2. Dynamic Named Ranges

Creating dynamic named ranges can make your formulas much more powerful and adaptable. Here’s how to set one up:

- Select the range you want to make dynamic.

- Go to Formulas > Define Name.

- Use a formula like

=OFFSET(Sheet1!A1,0,0,COUNTA(Sheet1!A:A),1)for a single column range.

📊 Note: Dynamic named ranges automatically adjust as your data grows or shrinks, making your models more resilient and easier to maintain.

3. Conditional Formatting for Financial Data

Conditional formatting in Excel allows you to visually distinguish between different types of data, making your financial models easier to interpret:

- Apply color scales to show profit/loss levels.

- Use data bars to represent revenue or expense amounts.

- Set up rules to highlight anomalies or key figures.

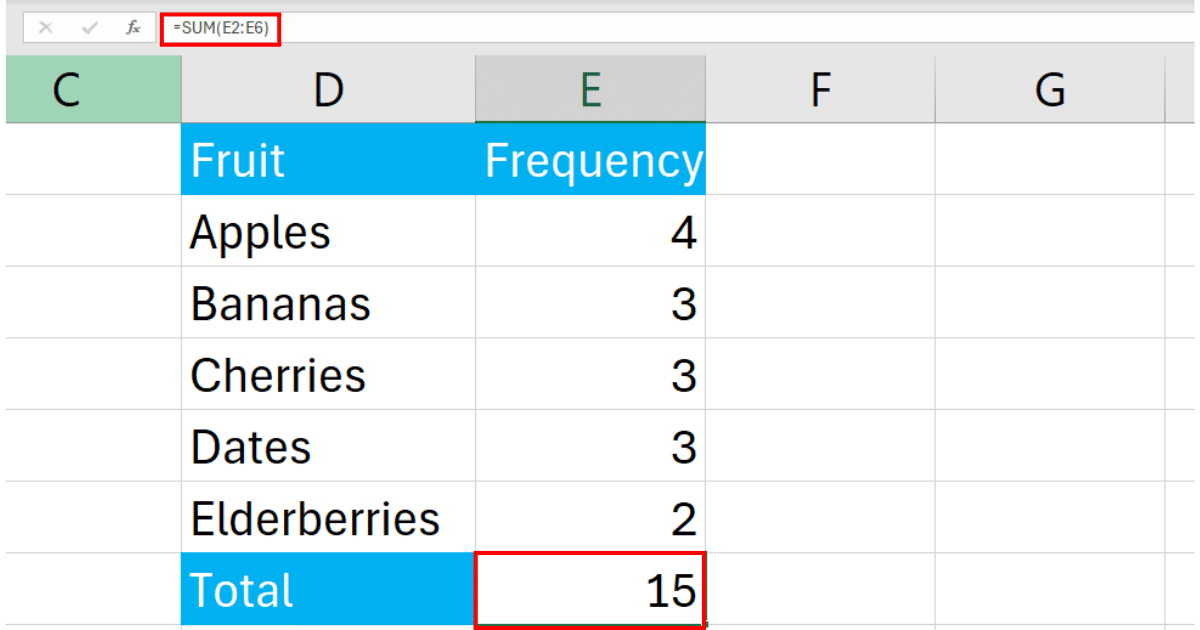

Here’s an example table demonstrating conditional formatting:

| Category | Amount | Status |

|---|---|---|

| Revenue | 1000 | High |

| Expense | -500 | Medium |

| Net Profit | 500 | Low |

4. Using VLOOKUP and Index-Match

While VLOOKUP is widely used, Wall Street Prep recommends understanding Index-Match for its flexibility:

- VLOOKUP: Works well for small datasets where columns are stable.

- Index-Match: More versatile; can lookup both vertically and horizontally.

=VLOOKUP(A2, B2:D100, 3, FALSE)

=INDEX(C2:C100, MATCH(A2, B2:B100, 0))

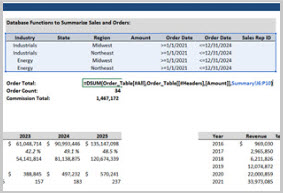

5. Implementing Error Checking and Auditing Tools

Excel has built-in tools to help with error checking, which can prevent mistakes in financial models:

- Use the Formula Auditing Toolbar to trace precedents or dependents.

- Error Checking: Excel flags common errors, allowing for quick correction.

- Data Validation: Set up rules to prevent invalid data entry.

After applying these tips, your Excel skills will not only become more efficient but also more accurate, aligning with Wall Street Prep’s rigorous standards. Understanding and using these tools can help you create more robust financial models that can withstand scrutiny from peers or clients. Remember, mastering Excel is an ongoing process; keep practicing these techniques, and soon they'll become second nature, enabling you to handle complex financial data with confidence.

What are the key advantages of using dynamic named ranges?

+

Dynamic named ranges automatically update when data changes, ensuring that your references always include the correct set of data. This feature minimizes manual updating, reduces errors, and makes your models scalable.

Can I use Index-Match for multiple criteria lookups?

+

Yes, Index-Match can handle multiple criteria lookups by combining MATCH functions with array formulas or by using additional helper columns.

How can conditional formatting benefit financial analysis?

+

Conditional formatting helps in quickly identifying trends, anomalies, or key financial figures by visually coding data. It aids in spotting performance metrics or deviations from expected values, thereby enhancing decision-making efficiency.

Related Terms:

- Excel basics wall street prep

- Free Excel Crash course

- CFI Excel crash course

- wall street excel shortcuts

- wall street prep excel shortcuts

- wall street prep excel certification