5 Easy Steps to Calculate Effective Interest in Excel

The intricacies of financial calculations can often be daunting. Among these, understanding and calculating the effective interest rate is crucial for personal finance, investment decisions, and loan structuring. This blog post will guide you through 5 easy steps to calculate the effective interest rate using Excel, ensuring you're equipped with the knowledge to make informed financial decisions.

Step 1: Gather Necessary Data

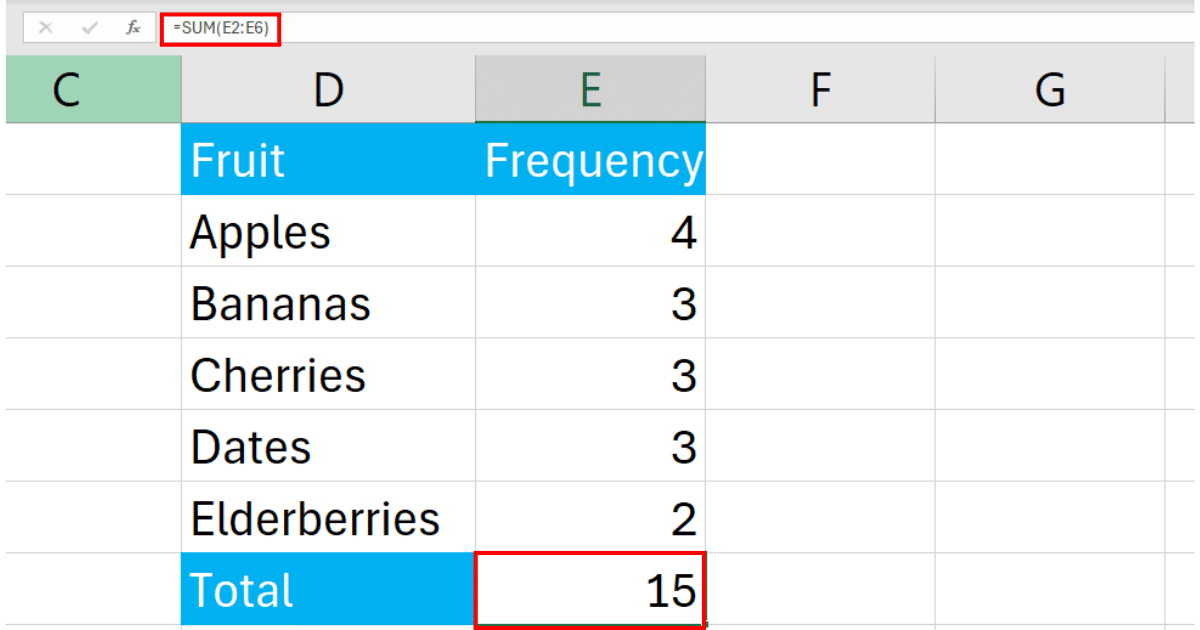

Before diving into Excel, you’ll need to gather specific data points:

- Nominal Interest Rate (Annual Percentage Rate - APR): This is the advertised interest rate for loans or savings accounts.

- Number of Compounding Periods per Year: This could be daily, monthly, quarterly, semi-annually, or annually.

- Investment or Loan Term: The duration for which the interest will be calculated.

💡 Note: Make sure the interest rate is expressed as a percentage or as a decimal for consistency in calculations.

Step 2: Convert Nominal Interest Rate to a Decimal

Excel functions work with decimals, not percentages:

=APR / 100

Suppose your nominal interest rate (APR) is 5%:

=5 / 100 = 0.05

Step 3: Calculate the Periodic Interest Rate

Divide the nominal interest rate by the number of compounding periods:

=Nominal_Interest_Rate / Compounding_Periods

If your loan compounds monthly (12 times a year):

=0.05 / 12 = 0.004167

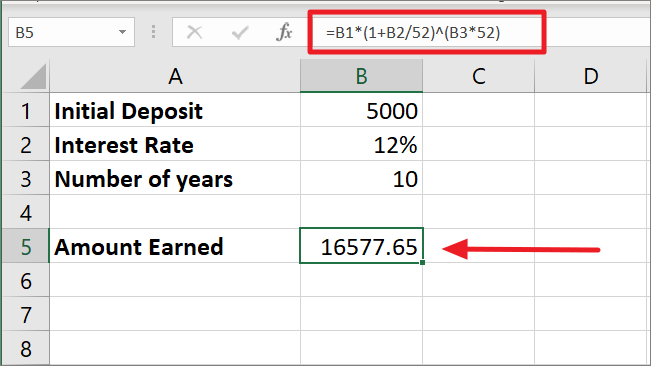

Step 4: Use Excel’s EFFECT Function for Effective Rate

Excel provides a function to simplify this calculation:

=EFFECT(Nominal_Interest_Rate, Compounding_Periods)

Using the previous example:

=EFFECT(0.05, 12)

This would yield an effective annual interest rate of approximately 5.12%.

Step 5: Interpret the Results

The result from Step 4 is your effective interest rate. Here’s what you should know:

- The effective interest rate reflects the actual interest earned or paid due to compounding.

- It’s higher than the nominal rate because of how interest is compounded over time.

- This rate provides a more accurate picture for comparison with other financial products.

📌 Note: Remember, if your loan or investment term isn’t an integer, rounding might be necessary for practical purposes.

In summary, calculating the effective interest rate in Excel is a straightforward process once you understand the foundational steps. From gathering the necessary data to interpreting the final results, Excel makes financial analysis accessible to all, simplifying complex calculations into a few formulas. With this knowledge, you can better compare financial products, understand loan terms, and make more informed investment decisions, thereby empowering yourself in the realm of personal finance.

What if my interest rate isn’t annual?

+If your interest rate is not annual, you’ll need to adjust it to the annual rate before using the EFFECT function. Multiply the non-annual rate by the number of periods in a year to get the annual nominal rate.

Can I calculate effective interest for any investment or loan term?

+Yes, the effective interest rate calculation applies to any term, but remember that for terms shorter or longer than a year, you’ll need to adjust your compounding periods accordingly.

How does the compounding frequency affect my effective interest rate?

+The more frequent the compounding, the higher the effective interest rate will be due to the power of compounding. More periods mean more times the interest is applied to the principal, leading to greater growth or cost.

Related Terms:

- effective interest rate template

- effective interest rate excel template

- apr to apy formula excel

- effective interest rate formula example

- effective annual rate excel formula

- excel formula for interest rate