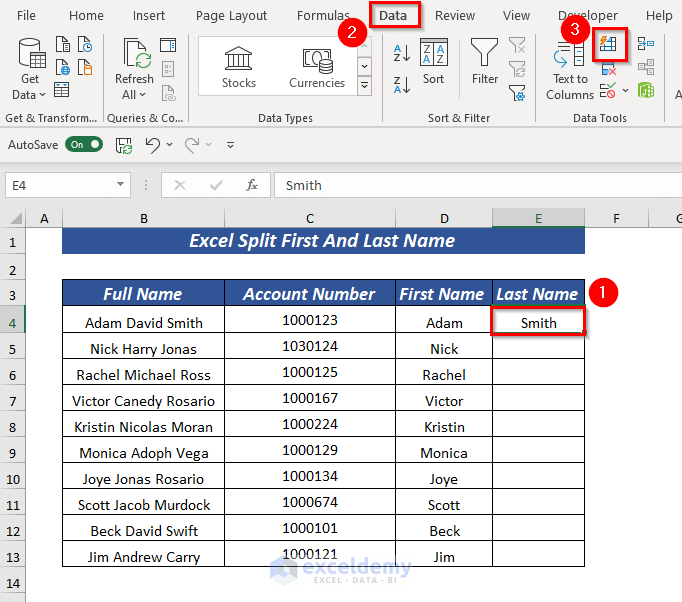

Excel Payback Period: Step-by-Step Guide

Calculating the payback period is an essential task for any business or individual looking to understand how long it will take to recover the costs of an investment. Whether you're considering a new piece of machinery, a renovation project, or any capital expenditure, knowing your payback period can help with financial planning and decision-making. In this blog post, we'll guide you through the process of calculating the payback period using Microsoft Excel, making it accessible for everyone from financial analysts to small business owners.

What is the Payback Period?

The payback period is the time it takes for the cash inflows from a project to equal the initial cash outflows or the investment cost. It’s a simple metric but incredibly useful for:

- Assessing liquidity risk

- Evaluating project risk (the shorter the payback period, generally the lower the risk)

- Helping decide between multiple investment options

Preparing Your Data for Excel

Before you start calculating in Excel, ensure you have the following data:

- Initial Investment: The total amount spent on the project or investment.

- Cash Flows: Annual or periodic cash inflows or outflows from the project.

These can be positive (inflows) or negative (additional outflows). Make sure to gather these figures accurately for the duration you plan to analyze.

Setting Up Your Excel Worksheet

Here’s how to set up your worksheet for calculating the payback period:

Step 1: Input Initial Investment

In cell A1, label it as “Initial Investment”. In cell B1, input the total initial investment cost.

Step 2: Input Cash Flows

Starting from cell A2, label each period (e.g., Year 1, Year 2). In the cells below this, input the expected cash flows:

| Period | Cash Flow |

|---|---|

| Year 1 | 50,000 |

| Year 2 | -10,000 |

| Year 3 | 70,000 |

| Year 4 | 85,000 |

Step 3: Cumulative Cash Flow

In cell B5, type “Cumulative Cash Flow”. Then in cell C2, write a formula to calculate the cumulative cash flow for each period. The formula for cumulative cash flow in cell C2 would be: =B2, and in cell C3 and onward: =C2+B3.

Step 4: Finding the Payback Period

There are two methods:

- Simple Method: If cash flows are consistent, you can use the formula: Payback Period = Initial Investment / Annual Cash Flow.

- Irregular Cash Flow Method: For more complex scenarios:

- Use the cumulative cash flow column to identify the year when cumulative cash flow turns positive.

- Use interpolation to calculate the fractional year when the initial investment is recouped:

Payback Period = Number of Years Before Recoup + (Initial Investment - Cumulative Cash Flow Before Recoup) / Cash Flow in the Year of Recoupment

Step 5: Implement Payback Calculation

Suppose your initial investment is 200,000, and your cash flows are as shown in the table above. Here’s how you calculate:</p> <ul> <li>Identify the year where the cumulative cash flow turns positive: Year 3, when cumulative cash flow is 110,000.

Payback Period = 2 + (200,000 - 110,000) / 85,000

This gives us a payback period of 2.47 years.

⚠️ Note: Ensure all cash flows are entered correctly. Incorrect cash flows can skew your results significantly.

💡 Note: If cash flows are highly uneven, consider using NPV or IRR as well for a more comprehensive analysis.

In Conclusion

Mastering the calculation of the payback period in Excel can empower you to make informed financial decisions. This metric provides a quick assessment of how long it will take to recoup your investment, which is vital for project management, budgeting, and investment analysis. While it doesn’t consider the time value of money or the profitability after the payback period, it’s a powerful tool for initial financial evaluation. Remember that the payback period is just one aspect of financial analysis, and combining it with other metrics like ROI, NPV, or IRR will give you a more holistic view of your investment’s potential.

Can the payback period be negative?

+

No, the payback period cannot be negative. It represents the time frame required to recover an initial investment. If the initial investment is never recouped, the payback period would theoretically be considered infinite.

How accurate is the payback period?

+

The payback period is a straightforward method but lacks consideration for cash flows after the payback, the time value of money, and the risk of the investment. It’s best used alongside other financial metrics for a full analysis.

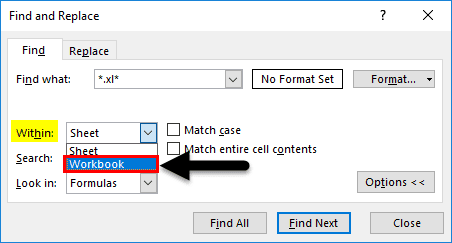

Is there a way to automate this process in Excel?

+

Yes, you can create an Excel formula or use VBA to automatically calculate the payback period for you, especially if you have numerous investments to evaluate.

Related Terms:

- payback period calculator

- calculate discounted payback period excel

- formula payback excel

- formula to calculate payback period

- cumulative cash flow formula excel

- payback period formula with example