Best Capital Loss Carryover Worksheet For Easy Learning

Best Capital loss carryover worksheet for Easy Learning - Understanding capital loss carryovers can be a crucial aspect of tax planning and management, especially for investors. It allows individuals to offset their gains with losses from other investments, ultimately reducing their taxable income. In this article, we’ll delve into the best capital loss carryover worksheets to facilitate your learning and improve your financial literacy. These worksheets not only simplify the calculations but also help you keep a clear record of your capital losses over the years. Whether you're a seasoned investor or just starting out, utilizing these resources can significantly aid in tax preparation.

Best Capital Loss Carryover Worksheets

Best Capital Loss Carryover Worksheets

Having a systematic approach to managing capital losses is essential for maximizing your tax benefits. Here are some of the top worksheets you can use:

1. Excel Spreadsheets

1. Excel Spreadsheets

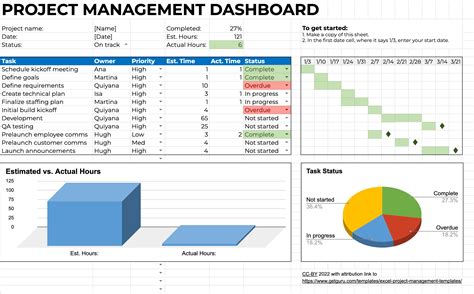

Excel spreadsheets are versatile tools that allow users to create customized capital loss carryover worksheets. These spreadsheets can automatically calculate carryovers and generate reports. You can input your losses, gains, and other relevant data to see your potential tax benefits.

- Advantages: Easy to customize, formulas can automate calculations.

- Disadvantages: Requires basic knowledge of Excel to set up properly.

2. Tax Software Solutions

2. Tax Software Solutions

Many tax preparation software programs come with built-in capital loss carryover worksheets. These tools guide users through the input of data and perform complex calculations seamlessly. Popular software like TurboTax or H&R Block often includes features specifically for tracking capital gains and losses.

- Advantages: User-friendly, designed to maximize tax benefits.

- Disadvantages: Typically requires a purchase, may have a learning curve.

3. Free Online Templates

3. Free Online Templates

Numerous websites provide free templates for capital loss carryovers. These templates are straightforward to use and can be printed out or filled in digitally. Sites such as Vertex42 or Template.net offer downloadable formats that you can adapt for your needs.

- Advantages: Cost-effective, simple layout for easy tracking.

- Disadvantages: Limited customization, may lack advanced features.

Understanding Capital Losses

Understanding Capital Losses

Before diving deeper, it’s important to define what capital losses are. In simple terms, a capital loss occurs when an investment's selling price is lower than the purchase price. These losses can be categorized as short-term (for assets held less than a year) or long-term (for assets held longer than a year).

Examples of Capital Losses

Examples of Capital Losses

| Investment | Purchase Price | Selling Price | Capital Loss |

|---|---|---|---|

| Stock A | $1,000 | $700 | $300 |

| Mutual Fund B | $500 | $400 | $100 |

Important Note: "Capital losses can be used to offset capital gains. If your losses exceed your gains, you can utilize the remaining loss to offset up to $3,000 of other income per year. Any losses above that can be carried over to the following year."

Using Your Capital Loss Worksheet for Tax Filing

Using Your Capital Loss Worksheet for Tax Filing

Once you have documented your capital losses using a worksheet, the next step is to apply this information during tax filing. Here are some tips to effectively utilize your capital loss worksheet:

- Accurate Reporting: Ensure that you accurately report your total gains and losses. Inaccurate reporting can lead to audits or penalties.

- Refer to IRS Guidelines: Always refer to the latest IRS guidelines for capital gains and losses, as tax laws can change.

- Consult a Tax Professional: If your situation is complex, consider consulting a tax professional to ensure compliance and optimization.

Benefits of Capital Loss Carryover

Benefits of Capital Loss Carryover

Utilizing capital loss carryovers can provide several benefits, including:

- Reducing your overall tax burden 💰

- Helping you manage your investment strategy better 📈

- Providing clarity in your financial statements 📊

In conclusion, managing capital losses through effective worksheets is an essential skill for investors. By utilizing spreadsheets, tax software, or free online templates, you can streamline your financial management and make informed decisions that align with your investment strategy. Always stay updated with tax laws and consider professional advice when necessary to maximize your financial outcomes.